WHY APARTMENTS

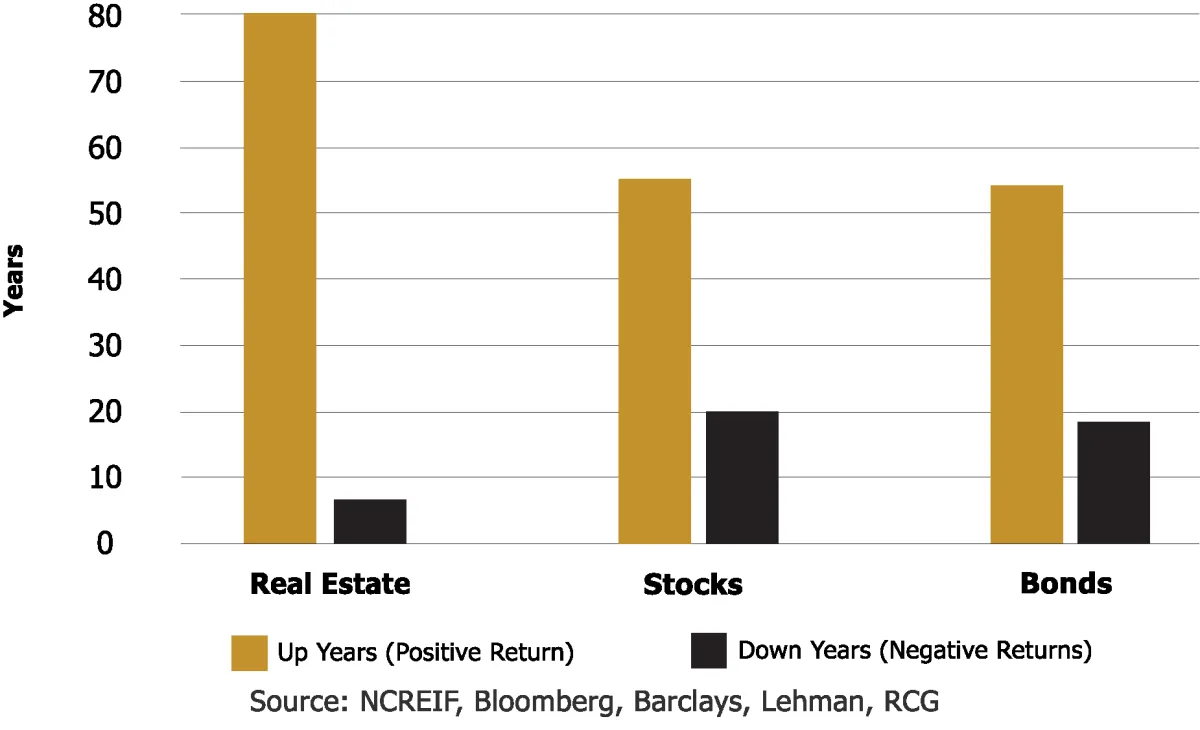

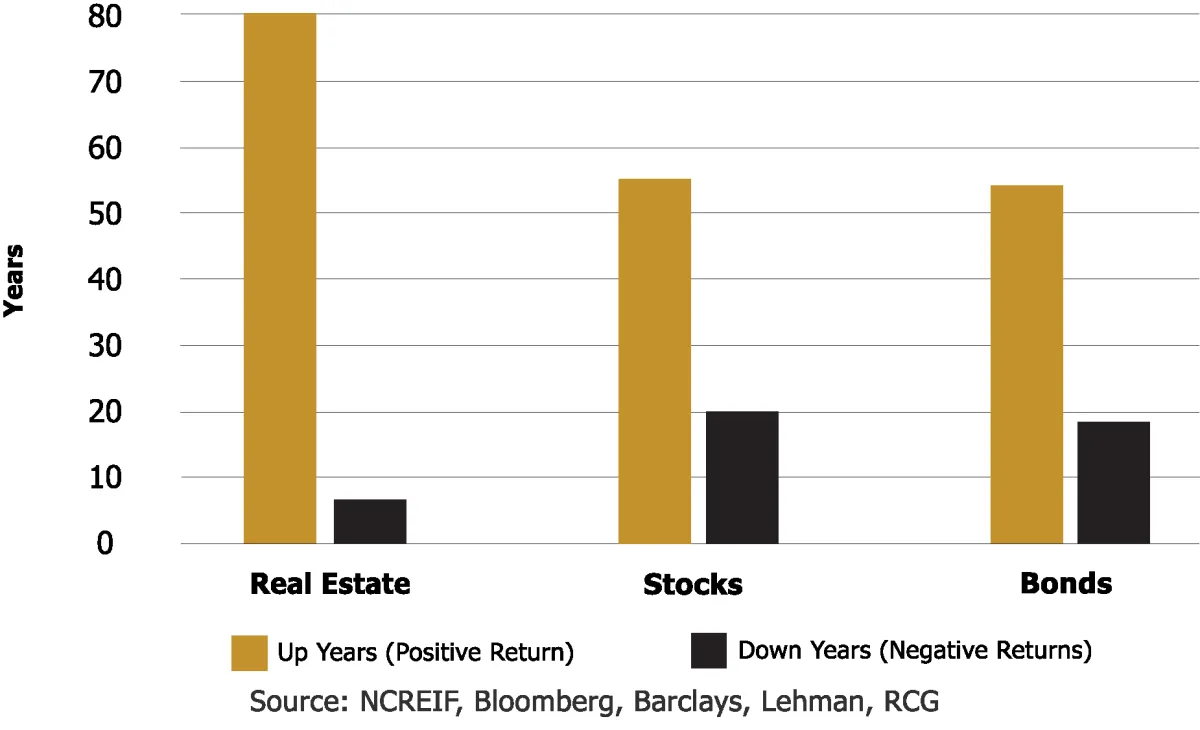

Apartments outperform stocks and bonds

Investing in apartments is wise for those who want to avoid high-risk investments. Not only can multifamily investments bring tremendous growth, they can provide monthly income more significant than what you would get from stocks and bonds, making it an even better choice if your goal is maximizing return on investment while minimizing the risk.

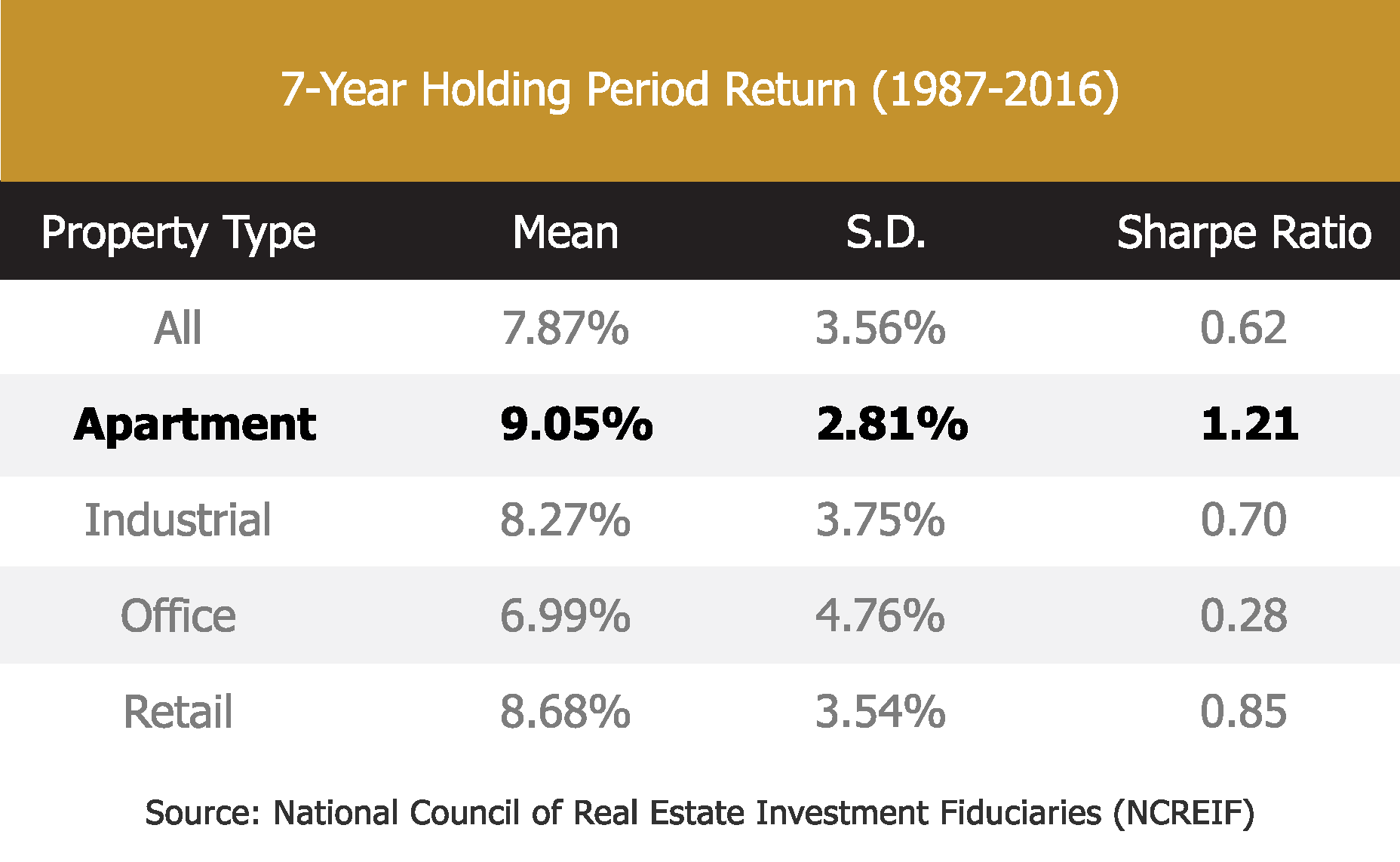

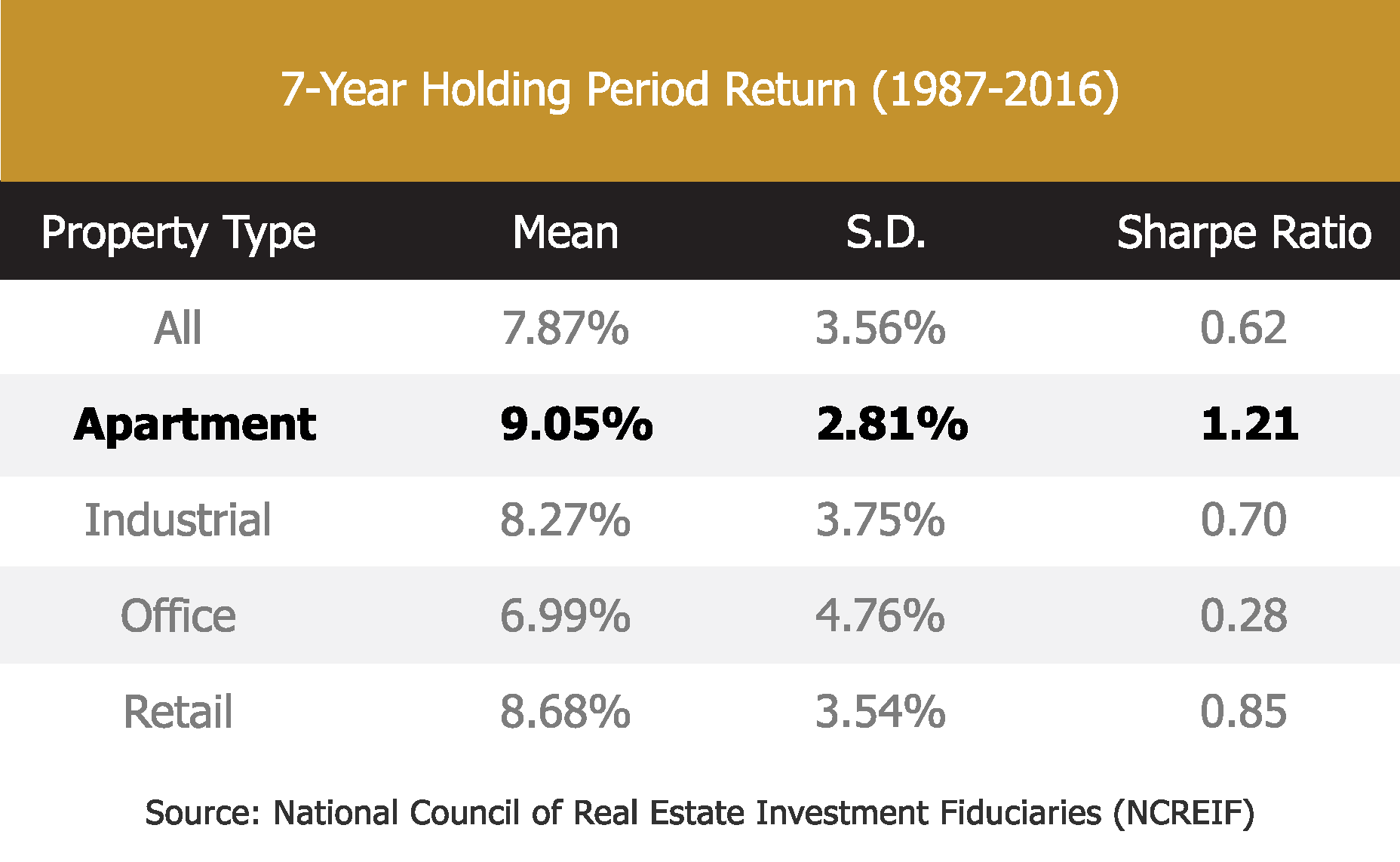

Multifamily investments outperform other real estate classes

Apartments have been the best investment amongst all other real estate classes. Because of the nature of multifamily properties and how we structure our investment properties, we can make significant cash flow plus equity growth which yields higher overall returns than all other real estate asset classes.

Apartments outperform stocks and bonds

Investing in apartments is wise for those who want to avoid high-risk investments. Not only can multifamily investments bring tremendous growth, they can provide monthly income more significant than what you would get from stocks and bonds, making it an even better choice if your goal is maximizing return on investment while minimizing the risk.

Multifamily investments outperform other real estate classes

Apartments have been the best investment amongst all other real estate classes. Because of the nature of multifamily properties and how we structure our investment properties, we can make significant cash flow plus equity growth which yields higher overall returns than all other real estate asset classes.

Take Advantage Of Increased Tax Benefits

Our team only acquires stabilized (above 80% occupancy) and cash flow-positive apartment building investments. This allows our investors to make healthy returns while showing a loss at the end of every year.

Take advantage of three types of depreciation that allow investors to lower taxes:

1

Standard or Straight-line Depreciation

2

Accelerated Depreciation

3

Bonus Depreciation

Cost segregation studies are performed on all of our assets and the tax benefits pass through to our investors via annual year end reporting on K-1s that are issued for the preceding year.

Demand for apartments is at an all-time high and still climbing

Since its peak in the mid-2000s, home ownership has been significantly dropping, and it will continue to drop as millennials, and aging baby boomers want to stay mobile in the 21st century.

Vacancy rates remain low due to increased demand

With the population continuing to increase, demand for apartments is at an all-time high. This increase drives the need for apartment living higher and higher. Low vacancy rates equal more significant cashflow and equity growth, which translates to higher returns for our investors.

Investors Love Working With Us

Discover the power of multifamily investments and unlock your financial potential. Contact us today for exclusive opportunities in emerging markets

Let's have a conversation about how real estate syndications can contribute to achieving your financial objectives.

Investors Love Working With Us

Discover the power of multifamily investments and unlock your financial potential. Contact us today for exclusive opportunities in emerging markets

Let's have a conversation about how real estate syndications can contribute to achieving your financial objectives.

ABOUT

St. Louis, MO

Deals@LStoneInvestments.com

(314) 501-6934

QUICK LINKS